Table of Contents

ToggleRetirement is a phase that everyone loves to think about, as it is away from the active work life with more time for yourself. However, retirement is also the time when your expenses would actually go up, instead of down with healthcare expenses. Then there is the need to maintain your lifestyle and also, if possible, fulfill your bucket list. So, retirement is a phase that you can actually enjoy provided you plan for it well in advance.

The bigger question is: How retirement ready are you?

According to the PGIM India Mutual Fund Retirement Readiness Survey 2020, most Indians don’t seem to have an active “plan” for retirement. They still depend on their children or family to take care of their retirement expenses. Around 89% of the people believe that they are not ready for retirement as they did not have any source for alternate income. So, while retirement definitely signals an end of your working life, your financial needs don’t end.

What do you need to meet such financial needs? A retirement corpus, obviously! If you have amassed a retirement corpus during your active working life, you can live out your golden years comfortably. How do you plan such a corpus? Through retirement planning, what else!

What is retirement planning?

Retirement planning, in layman’s terms, means building a corpus for your retirement. It involves setting aside funds when you are working and earning an income, so as to create a retirement fund. This fund can, then, be used when you retire to meet

• Lifestyle expenses • Medical expenses • Fulfilment of bucket list • Creating a legacy So, when you plan your retirement, you invest today so that you can be financially free after retirement.

Benefits of Retirement Planning

Retirement planning helps you create a retirement corpus that is needed after retirement. Moreover, it gives the following benefits too –

1. Financial independence: Creation of a good retirement corpus = Financial Freedom Thus, you do not have to depend on anyone for your financial needs and you can be financially independent even in your old age.

2. Fulfilling your dreams: A good retirement corpus will help you fulfill your dreams that you could not during your active work life like exotic vacation, luxury car or house, etc. This is the time when you can peacefully think about your dreams without having the other financial responsibilities of your child’s education, etc.

3. Creating a legacy A sufficient retirement corpus can help your leave behind a legacy for your family and children.

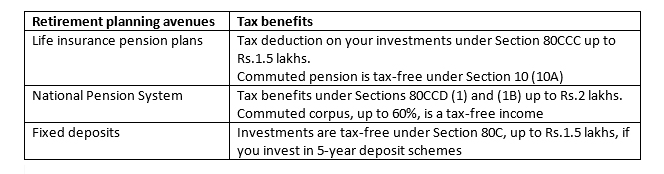

4. Tax planning There are different types of retirement planning avenues that give you tax benefits that can reduce your tax liability while helping you save for your retirement. Have a look –

Tips for Retirement Planning:

Retirement planning is, therefore, an important aspect of financial planning, one in which you should not procrastinate. In fact, when making a financial plan, you should set aside funds for your retirement too.

1. The earlier you start, the higher the corpus that you can create.

2. Choose suitable investment avenues that would help you attain an inflation-adjusted corpus and invest in a disciplined manner.

Use our retirement planner calculator to project your savings and for expert help on planning, you can take the help of professional certified financial advisors. Financial advisors are experts in the world of finance and would help you create the best retirement plan. Financial planners would also review your retirement plan regularly to ensure that it is on track and that it provides you with a sufficient corpus for retirement. Start retirement planning when you are young. Reap the benefits of retirement planning and create an inflation-adjusted corpus to serve your golden years in the best possible manner.