Many people want to invest but simply don’t have the time, expertise, or patience to research markets, analyse companies, and track performance every now and then. Mutual funds help bridge this gap by allowing gradual investments while professional fund managers manage complexities and optimize portfolio performance.

However, for investors seeking more personalised strategies and greater control over their portfolios, mutual funds may not feel sufficient. An investment service, known as portfolio management services, or simply PMS, is designed to keep your financial goals, risk appetite, and other preferences in view.

PMS is a SEBI-regulated service suited for high-net-worth individuals, as the minimum investment amount required is Rs. 50 lakh. Let’s explore the types of PMS, their benefits, and how to choose the best option tailored to your investment needs.

Features of PMS

Keywords: portfolio management services

- Like mutual fund investments, portfolio management services are vigilantly regulated by SEBI. Providers must adhere to their rules, such as clear client agreements, KYC norms etc to protect the interests of investor.

- Investors gain much higher control over asset allocation and investment choices compared to mutual funds.

- PMS investing starts with at least Rs. 50 lakh, however, many PMS set minimum investment amounts well over Rs. 1 crore.

- Investment strategies are customised based on the investor’s financial goals, risk tolerance, and investment horizon.

- PMS charges a variety of fees, like management fees, profit-sharing fees (based on the portfolio’s performance), entry & exit loads.

- Managers ensure that the portfolio is diversified and regularly rebalanced to maintain desired levels of risk.

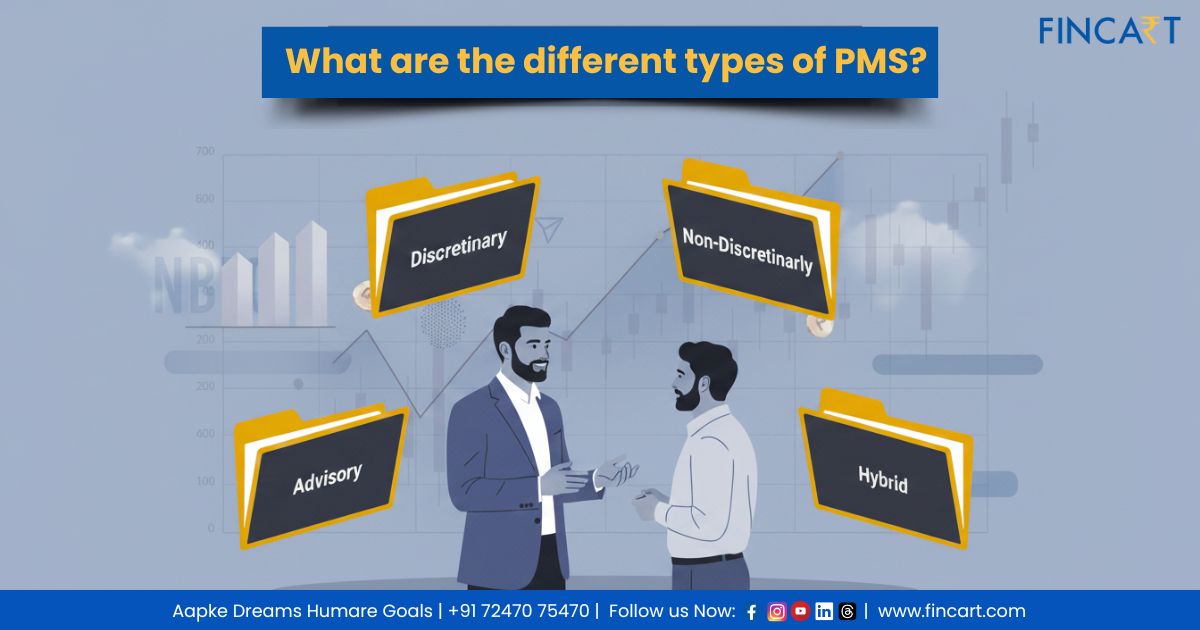

Types of PMS

Keywords: types of pms, pms services, pms investment

Broadly speaking, there are three types of pms one can choose from. These are discretionary, non-discretionary, and advisory pms services. Each of these differs in the level of control the investor retains over their portfolio and also in how investment decisions are made.

Discretionary Portfolio Management Services

When you choose to go with this kind of pms investment, you’re essentially giving full authority to the portfolio manager to make investment decisions on your behalf. A discretionary manager independently makes all buying and selling decisions on your behalf, without requiring your approval for each transaction.

This does not imply that the manager would deviate from your predefined financial goals and risk profile. At the time of onboarding, you’ll have a detailed discussion with the portfolio manager to outline your objectives, time horizon, and risk appetite. Using this information, the manager may suggest existing models or craft a personalized strategy and make decisions within agreed limits. The primary goal is to maximize returns while ensuring your portfolio remains consistent with your long-term financial objectives and plan. Also, the manager must adhere to various SEBI guidelines so that your interests are always kept at the forefront.

2. Non-Discretionary Portfolio Management Services

As you can guess by the name, portfolio managers do not have the freedom to make buy or sell decisions. Instead, they involve clients in the decision-making process. Managers offer recommendations and advice, and ultimately, it’s the client who holds the final word over every trade. Once an investment decision is approved, the portfolio manager executes the trade on behalf of the client.

This approach also offers certain advantages. It allows investors to stay involved in managing their portfolios while still benefiting from professional expertise. However, you may notice that the expense ratios for these pms services may be slightly higher compared to their discretionary counterparts.

3. Advisory Portfolio Management Services

This is the simplest PMS service and is more suited to those who have the time and knowledge to make and execute their own investment decisions. The manager plays the role of a guide and only offers investment advice. The investor thus retains complete control over their portfolio.

Factors to Consider When Selecting PMS

Keywords: portfolio management services, pms services

If you’re interested in investing through portfolio management services, you should take into account the following factors:

- PMS Reputation: Always start by looking into the reputation of the PMS provider. Firms that are SEBI-registered, have sizable assets under management, and are known for consistent performance and transparency are the ones worth considering.. You should read client reviews and check testimonials to get a clearer picture of their credibility.

- Manager’s Track Record: The expertise and experience of the portfolio manager will ultimately decide how well your investment performs, making this an essential factor to assess. Review their past performance and investment philosophy to understand how the manager handled different market conditions and managed risks.

- Minimum Investment Amount: PMS caters primarily to high-net-worth individuals, as is reflected by the minimum ticket size of Rs. 50 lakh. However, different firms may have different minimum amounts, so check the specific eligibility criteria and investment thresholds to ensure that you’re comfortable committing it for the long term.

- Fees Involved: PMS charges can be fixed, meaning you’ll pay a certain percentage of your assets under management, or performance-based, where the manager earns a fee if returns cross a benchmark. Some providers use a model that combines both types. There are also administrative and brokerage charges involved, so be sure to thoroughly understand the cost structure, as hidden fees can eat into your returns.

- Investment Strategy: PMS providers have different models for managing portfolios, each with its own philosophy. For example, it’s important to assess whether the portfolio manager prefers growth investing, value investing, or a blend of both, and see if that aligns with your own investment style. You should also understand the asset allocation strategy and the level of diversification across industries and stocks. Understand how the manager plans to mitigate risks and adjust the portfolio during volatile times.

- Control Over Portfolio: As you know, pms services differ mainly on the basis of varying degrees of control. Pick the one that suits your preferred level of involvement.

How To Select The Right PMS

Keywords: portfolio management services, types of pms

So, how do you decide which of the three types of pms is best suited for you? The answer largely depends on how hands-on you want to be with your investments and how much trust you place in your manager.

1. Discretionary PMS

If you’re someone who doesn’t have the time or knowledge to make investment decisions, discretionary portfolio management services might suit you best. Let a trusted portfolio manager take full control of your investments and act on your pre-defined financial goals and risk profile. You will, however, have to do your due diligence and select a service you can rely on.

If you trust the manager’s experience and are comfortable with them handling all decisions, you can relax and let an expert do all the hard work. This way, whenever new opportunities arise, the manager can capitalise on them quickly without waiting for your approval.

2. Non-Discretionary PMS

If you want to have the final say over all your investments, you can opt for non-discretionary PMS. You’ll retain a certain degree of control over your portfolio while benefiting from professional advice. Since the absolute decision on buying or selling always rests with you, you’ll need to have some knowledge of how the markets work to make optimal investments. The portfolio manager will give you research-backed recommendations, and upon your approval, the trade will be carried out.

A small disadvantage of going with this PMS type is that execution cannot happen without explicit approval, meaning any delay in approving a trade may result in missing out on time-sensitive opportunities.

3. Advisory PMS

While advisory PMS gives you the maximum control over your portfolio, it also demands a higher level of market understanding. Here, the manager’s role is reduced to only providing expert advice, while you take full responsibility for executing trades. You’ll need to track market trends, act quickly on insights, and manage the portfolio performance yourself.

Benefits of PMS

Keywords: portfolio management services

Let’s take a look at some reasons why portfolio management services are emerging as an attractive option for many investors in India:

- Professional Management/ Advice: Most investors have limited knowledge, time, and tools to track markets or analyse individual stocks effectively. With PMS, your money is handled by experienced professionals who specialise in researching trends and identifying the best opportunities. They have access to superior analytical tools, data, and company research, which enables them to make sound investment decisions.

- Higher Customisation: The level of personalisation offered by PMS is higher compared to mutual funds. Your portfolio is designed and managed keeping your specific financial goals, horizon, and risk appetite in mind.

- Risk Management: A PMS manager takes several risk-mitigating steps to protect your money’s worth. They also optimally diversify your portfolio by spreading investments across sectors and asset classes to reduce risk without diluting returns too much.

- Saves Time: Investing can be time-consuming and stress-inducing. Since not everyone has the time to research markets, track stock performance, or rebalance their portfolio, PMS takes this responsibility off your shoulders and allows you to focus on more important things like your profession or spending time with loved ones.

- Low Churn Rate: Frequently buying and selling securities can lead to high transaction costs and taxes, which eat into your returns. Portfolio management services focused on the long-term not only minimise unnecessary expenses but also allow your investments to compound more efficiently in the long run.

- SEBI Regulation: All PMS providers are regulated by the SEBI, so they must abide by strict compliance and disclosure norms.

Conclusion

Keywords: types of pms, portfolio management services

Portfolio management services, are investment services designed for HNI investors who seek a more personalised approach to wealth creation. Under PMS, professional managers handle portfolios based on their clients’ financial goals and risk tolerance. As we’ve seen, there are different types of pms: Discretionary, non-discretionary, and advisory, each of which caters to different levels of investor control. While discretionary PMS is more suitable for those who prefer to leave all decisions to professionals, non-discretionary PMS is geared towards investors who want to have a say over every decision.

Whichever type you choose, the goal of PMS is to maximise returns and manage risk effectively. You benefit from expert research, quick decision-making, and customised portfolio strategies; however, remember to evaluate factors like the manager’s historical record, investment philosophy, and the PMS fee structure before committing to one. Consider consulting with certified financial advisors who can point you in the direction of a reputable PMS that best aligns with your financial goals and risk tolerance.