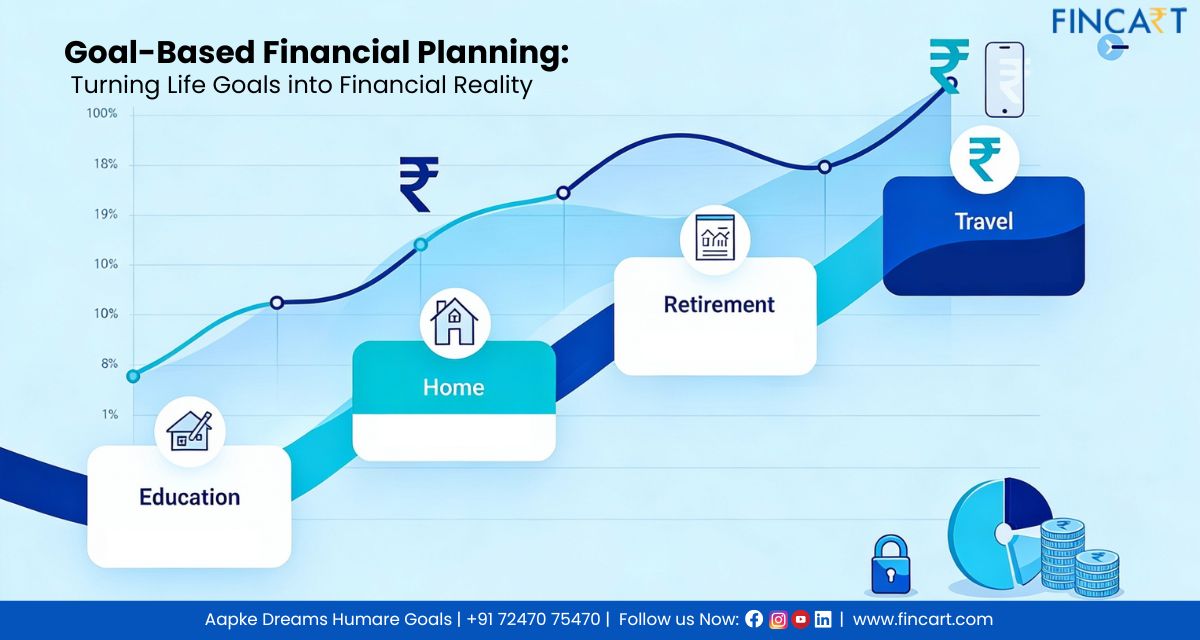

For most people, financial planning begins with products—mutual funds, insurance policies, fixed deposits, or stocks. Conversations often revolve around returns, past performance, and market timing. While these aspects are important, they address only part of the picture. True financial success does not come from owning the “best” product. It comes from achieving life goals at the right time, with confidence and financial security. This is where Goal-Based Financial Planning becomes not just relevant, but essential.

Goal-based financial planning aligns your money with your life—ensuring that every financial decision supports what truly matters to you. Let’s take a deeper look at this concept, its importance, and how it applies in real life in this article.

Understanding Goal-Based Financial Planning

Goal-based financial planning is a structured approach where investments are designed and managed around specific, well-defined life goals rather than standalone products or market trends.

Each goal is planned with clarity around:

- What you want to achieve

- When you want to achieve it

- How much will it cost in the future

- How much risk can you afford to take

Instead of asking, “Which fund will give the highest return?”, the focus shifts to, “What investment strategy will help me achieve this goal with the highest probability?” This shift in thinking transforms investing from speculation into purposeful planning.

Why Traditional Investing Often Fails

Many investors save and invest regularly, yet struggle to meet key life goals. The reasons are common:

- Lack of clarity – Investments are made without a defined objective.

- Mismatched risk – Short-term goals are exposed to high-risk assets.

- No inflation adjustment – Future costs are underestimated.

- Emotional decisions – Panic during market volatility leads to poor timing.

- No tracking mechanism – Progress towards goals is never measured.

Goal-based planning addresses these gaps by bringing structure, discipline, and accountability to financial decisions.

Common Financial Goals Across Life Stages

Every individual goes through multiple life stages, and each stage comes with its own set of financial priorities.

| Goal Tenure | Requirement | Investment Options |

| Short-term goals (0-3 years) | These goals require high liquidity and low volatility. Emergency fund creationVacation planningBuying a carShort-term skill upgrades or certifications | Capital protection is more important than high returns for such goals. Fixed DepositRecurring DepositGovernment BondsCorporate BondsBond FundsP2P LendingMarket CreditGuaranteed Income Investment Plans, etc. |

| Medium-term goals (3-7 years) | These goals balance growth and stability. Buying a house or plotChild’s early educationWedding expensesBusiness setup or expansion | A mix of equity and debt is often suitable, depending on risk tolerance. NPSBalanced Advantage FundsAlternative Investment FundULIPs, etc |

| Long-term goals (7+ Years) | These goals benefit the most from compounding. Child’s higher educationRetirement planningFinancial independence (FIRE)Wealth creation and legacy planning | Equity-oriented strategies play a crucial role here. Index FundsPassive FundsActively Managed Mutual FundsULIPsDirect Listed EquityPortfolio Management ServicesAlternative Investment FundsUnlisted or Private-Based Investments |

The Core Pillars of Goal-Based Financial Planning

Goal-based financial planning works best when it follows a clear framework. These five core pillars form the foundation for building a financial plan that stays focused, flexible, and effective across life stages.

1. Goal Identification and Prioritisation

Not all goals carry equal importance. Needs such as retirement, emergency funds, and children’s education usually take precedence over lifestyle goals.

Prioritising goals ensures that limited resources are allocated efficiently.

2. Inflation-Adjusted Goal Costing

One of the biggest planning mistakes is calculating goals in today’s value. For example, a college education costing ₹20 lakh today may require over ₹50–60 lakh after 15 years due to education inflation. Goal-based planning always works with future value, not present cost.

3. Risk Profiling and Time Horizon Mapping

Risk capacity depends on:

- Income stability

- Existing assets and liabilities

- Time available to achieve the goal

- Emotional comfort with market fluctuations

Longer timelines allow higher equity exposure, while shorter timelines demand safety.

4. Goal-Specific Asset Allocation

Each goal gets its own investment strategy:

- Short-term goals → Low-risk instruments

- Medium-term goals → Balanced allocation

- Long-term goals → Growth-oriented allocation

This separation ensures that market volatility does not derail near-term objectives.

5. Regular Review and Rebalancing

Life changes—income grows, responsibilities increase, goals evolve. Markets also move in cycles.

Periodic reviews help:

- Track progress against each goal

- Rebalance portfolios

- Adjust contributions or timelines

- Incorporate new goals

A static plan rarely succeeds. A dynamic plan does.

Goal-Based Planning vs Product-Based Investing

| Product-Based Investing | Goal-Based Financial Planning |

| Focus on returns | Focus on outcomes |

| Random product selection | Purpose-driven strategy |

| Emotional reactions to markets | Disciplined decision-making |

| No timelines | Clear timelines |

| Low success probability | High goal achievement probability |

The Role of Asset Allocation in Goal Achievement

Asset allocation is the backbone of goal-based planning. Rather than chasing returns, asset allocation ensures:

- Risk is aligned with the goal’s timeline

- Volatility is managed effectively

- Long-term growth potential is maximised

Studies consistently show that asset allocation contributes more to investment success than fund selection or market timing.

Importance of Behavioural Discipline

Markets will always fluctuate. What separates successful investors from unsuccessful ones is behaviour.

Goal-based planning helps investors:

- Stay invested during market corrections

- Avoid panic selling

- Ignore short-term noise

- Focus on long-term objectives

When investments are linked to meaningful goals, decision-making becomes calmer and more rational.

Tax Efficiency in Goal-Based Planning

Tax planning is an integral part of goal-based financial planning. Proper structuring can:

- Improve post-tax returns

- Reduce unnecessary tax leakage

- Optimise withdrawals during goal execution

Tax efficiency is especially critical for long-term goals like retirement and education planning.

Retirement: The Most Critical Goal

Retirement is often the largest and longest financial goal in one’s life. Goal-based retirement planning focuses on:

- Building a retirement corpus

- Generating sustainable post-retirement income

- Managing longevity risk

- Protecting against inflation

- Planning for healthcare expenses

Without goal-based planning, retirement often becomes uncertain and stressful.

Who Should Adopt Goal-Based Financial Planning?

Goal-based planning is not limited to high-income individuals. It is relevant for:

- Young professionals starting early

- Families juggling multiple responsibilities

- Business owners with fluctuating income

- Pre-retirees planning stability

- Retirees managing income and capital

If you have goals—and everyone does—you need goal-based planning.

Benefits of goal-based plans

There are multiple advantages of goal-based financial plans, such as:

1. Clear Financial Direction

Goal-based financial planning gives your money a clear purpose. Instead of investing without direction, every decision is linked to a specific life goal—such as buying a home, funding your child’s education, or planning for retirement.

2. Right Risk for Every Goal

Different goals require different levels of risk. Goal-based planning ensures the right mix of assets is chosen based on the time horizon and importance of each goal, helping balance growth and safety.

3. Stronger Investment Discipline

When investments are tied to meaningful goals, investors are less likely to react emotionally to market volatility. This encourages long-term discipline and consistent investing, which is critical for wealth creation.

4. Better Tracking and Timely Course Correction

Goal-based planning allows you to regularly track progress toward each goal. If income, expenses, or market conditions change, timely adjustments can be made to stay on course.

5. Confidence and Peace of Mind

Knowing that important life goals are backed by a structured plan reduces financial anxiety. It brings confidence that you are prepared not just for today, but for the future as well.

Role of a Financial Advisor in Goal-Based Planning

A professional financial advisor brings structure, clarity, and objectivity to the goal-based financial planning process. At Fincart, we believe financial planning is not just about recommending products—it is about building long-term partnerships that help individuals and families achieve life’s most important goals with confidence.

As trusted advisors, we help you by:

- Translating life goals into numbers

- Creating customised goal-based strategies

- Managing asset allocation and rebalancing

- Providing behavioural support during market volatility

- Ensuring tax efficiency across goals

- Monitoring progress continuously

At Fincart, our human expertise is complemented by a robust, technology-enabled advisory platform that enhances transparency, tracking, and ease of execution. Our clients benefit from:

- Real-time goal tracking and portfolio visibility

- Data-driven insights for better decision-making

- Seamless execution and reporting

- Regular reviews backed by both technology and expert advisors

By combining expert human advice with smart technology, Fincart ensures your financial plan stays relevant, resilient, and aligned with your life goals—today and in the future.

Common Myths Around Goal-Based Planning

Myth 1: I need a high income to plan goals

Reality: Planning is even more important with limited resources.

Myth 2: I can do this later

Reality: Time is the biggest advantage in financial planning.

Myth 3: I already invest, so I’m covered

Reality: Investing without goals is incomplete planning.

Final Thoughts: Money with Meaning

Goal-based financial planning shifts the conversation from products to purpose, from returns to results, and from uncertainty to confidence. Markets will rise and fall. Economic conditions will change. But a well-structured, goal-oriented financial plan keeps you focused on what truly matters—your life goals.

At Fincart, we help you identify, prioritise, and plan your goals, so your money works in alignment with your life. Because ultimately, money is not about beating the market—it’s about building the life you envision with clarity and confidence.